Share this

Quarterly Newsletter

by Dane Czaplicki on Oct 16, 2023

Members' Wealth Quarterly Update | Q3 2023

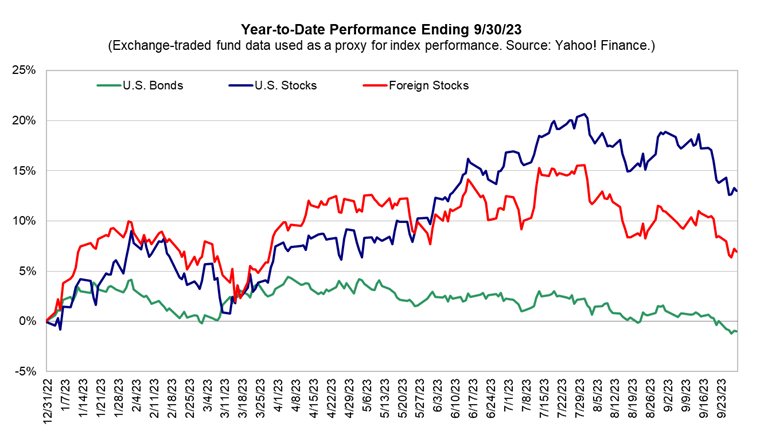

Year to Date (YTD) performance in stocks has been positive (See Figure 1 – Year to Date Performance) though this could be seen as quite misleading, which we will discuss in detail in the Equity section below. While YTD stock performance is positive, the tail end of the 3rd quarter and the start of the 4th quarter have been negative. But aren’t September and October always seemingly or actually a little rocky? (See our blog insight: Preparing for the Fall). Throw in the power move of higher interest rates and the resulting pressure on bond prices along with the current investment environment, and it can all seem daunting. Recently, there seems to be a lot to be negative about. So why are we the most optimistic we have been in a long time? Mostly because others are so negative.

Figure 1 - Year To Date Performance

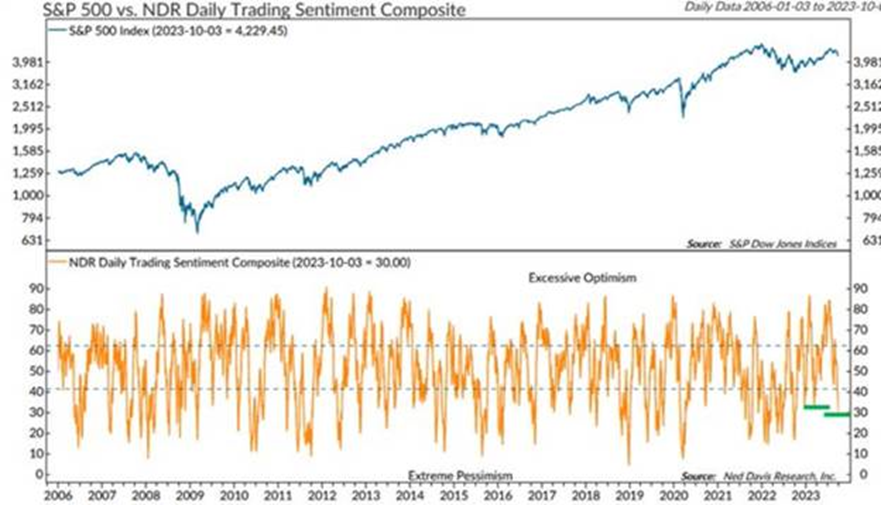

The collective negativity or positivity of all investors is referred to as “Investor Sentiment”. This can be measured a few ways, but regardless of the means used to measure, greed and euphoria have long since left the collective psyche and investors tend to be, at least in the aggregate, more in a state of fear (Figure 2 Fear and Greed Index) (Figure 3 Pessimism Among Traders).

[i]Figure 2 - Fear and Greed Index[ii]

Figure 3 Pessimism Among Traders

Stocks are down recently, bonds are in a full-fledged bear market, and sentiment is poor. This sounds a bit like an opportunity to us at Members’ Wealth. You have the opportunity to make the most money when you capitalize on a bear market, you just do not know it at the time[iii]. So, let’s look at the opportunities and risks as we see them.

Cash – Everyone’s New Favorite Asset Class

Our office’s hometown, Media PA, had its annual town-wide yard sale this month. The local town-talk newspaper referenced a resident as talking about the joy the day brings realizing that the possessions one may consider trash can be transitioned to another as a treasure. The parallel to cash as an investment was uncanny. Just a short three years ago, the best investment was borrowing as much as you could for as long as you could at what at the time was 2%-3% interest rates. You wanted to be the borrower and you sure did not want to be sitting on cash earning nothing and losing on an inflation basis. Nevertheless, cash, like any other investment, has its good times and its bad times. Now just happens to be one of the good times. Enjoy those 5% yields. Hopefully, they are here to stay. We remain content if we must be in cash, however, not complacent. Our intent is to move away from cash to other more attractive long-term opportunities.

Bonds – So Exciting. No. really!

Interest rates are where the action is today. Bond prices fell back in the quarter, with the bellwether 10-year U.S. Treasury note rising in yield from 3.8% to 4.6% during the period. (When yields rise, prices fall). It is no surprise to us that investors appear torn (we are too!) between the attractiveness of higher current yields, particularly if rates eventually decline due to economic slowing, and the possibility that rates will still rise further. Notably this quarter, the Federal Reserve (Fed) increased the key short-term rate by 0.25% in July to a level of 5.25-5.50% but held rates steady in September—while preaching vigilance about price inflation. And they better!!

Why? Interest rates are a key component of the pricing mechanism of EVERYTHING. However, the importance of rates was forgotten by many as rates had been suppressed for so long. So ingrained, in fact, that rates have no impact on pricing, this epic, record-paced move upward in all rates globally has yet to really break the back of what in any era prior to the most recent would have seen prices of just about every asset class demolished.

They're baaacckkk!!! It now seems clear that the bond vigilantes[iv] are out, and rate increases are picking up the pace. Perhaps taking the baton from the Fed, which seems to be nearing an end to their tightening cycle. We have noted before (After The Fed) what we think investors should generally expect after the end of a Fed interest cycle…now adding the caveat to be mindful of the vigilantes (has a nice Halloween ring to it 😉)

We want to speak generally to all investors about what to expect from Members’ Wealth when it comes to the bonds in your portfolios (exact specifics for each investor will be discussed at your upcoming quarterly meeting). Bonds have moved from zero or near zero percent interest rates to levels not seen in over 15 years. At the same time, the U.S. treasury yield curve has remained caught in a persistent inversion—short-term rates higher than long-term rates—a classic leading indicator of every U.S. recession since the late 1960s. Importantly, with interest rates at this higher level, bonds have become more competitive with equities. (Starting yield can be seen as a reasonable estimate of multiyear total returns in fixed income.)

Investors are nervous and why shouldn’t they be? There is talk of a debt crisis; soaring interest costs, inflationary pickup in social security outlays, the Fed shrinking balance sheet (quantitative tightening); too much bond supply relative to demand; etc. The bond market will naturally adjust yield upward to clear the market of supply. So far so good. This is natural and not really a problem. However, the risk is that the market yield will crowd out the credit demands for the private sector. Lack of credit, or credit crunch, can lead to and most likely would cause a recession. To combat this scenario, the government would have to reduce spending and/or increase taxes, which is fuel to a recessionary fire, rather than an extinguisher. The worst case leads to a deflationary debt spiral. Deflation is way worse than inflation in our opinion. If this were to happen, The Fed would most likely be forced to lower interest rates and terminate its quantitative tightening. Pretty gloomy but does it have to end this way?

We have talked about this before. (Bond Bear Market 10/09/2023 Insight). Rates have been abnormally low for 15-plus years. Abnormally low. We have managed the bond portion of portfolios with shorter duration[v] for just as long for investors, both at Members’ Wealth and predecessor firms. Rates are normalizing, getting there is painful. But being there is welcomed, and we will continue to adjust portfolios accordingly for the new environment. We are in a bond bear market, perhaps of epic proportion, and we plan on laying the foundation for making the most money in a bear market, even if we do not quite know it at this time. Because of this – you may witness higher levels of trading in the bond portion of your portfolio as we seek to gradually move out the duration of your bonds as rates continue to rise. Our research indicates that the best time to begin to extend duration is as rates rise, rather than try and wait for a top in rates. (Trying to top rates is akin to market timing, something we make no claim to be good at). As such, investors can expect some “red” in their bond prices on initial purchases, if rates continue to rise. Price is only part of the return equation. We are locking up some great yields that will be paid out over time. We remind investors that as bond investors, in the short run, you may want yields to drop to see green in prices, but in the long run, you want rates to rise to generate more income and higher returns. Rising rates are the friend of the bond investor, even if it does not seem like it initially.

Credit- Is it worth the added risk?

While the continued interest rate increases of the last year took their toll on many sorts of bonds, those bonds with very short duration, lower quality, and much higher yields, along with those bonds with a floating rate feature (whose rates rise with the market) have helped to blunt the price declines in the broader bond segment of your diversified portfolio. Because credit quality is a consideration for these types of bonds, future economic growth, or lack thereof, will influence these bonds as lower-rated companies inherently carry more credit risk and those risks are exacerbated in a weak economy. So far in 2023, for those investors with exposure here, lower credit quality has been a standout in the bond portion of portfolios as a top performer.

As a reminder, credit spreads can serve to indicate the level of distress or complacency in the corporate bond market. Currently, spreads continue to run at just below average levels in the investment-grade bond market and expensive/tight levels for lower-rated high-yield bonds. As defaults for lower-rated bonds have been rising, this segment appears a bit riskier given current quotations. However, fundamentals in the larger investment-grade market appear healthy relative to late-cycle environments. At Members’ Wealth, where appropriate for specific investors, we will continue to have conservative exposure in this space but remain guarded.

Alternatives

Each quarter we like to highlight an alternative strategy. Part update, part education. What is an alternative? At Members Wealth, an alternative is something that is not traditional, duh (Traditional being an investor owning with the expectation of income and/or price appreciation from bonds, stocks, and cash). Alternatives can include but are not limited to Real Estate, Private investments, long/short, market neutral, event-driven, convertible bonds, merger arbitrage and this month's feature is trend-following strategies or managed futures.

Trend-Following Strategies/Managed Futures

Thesis or why to use them: To complement a traditional portfolio. Trend following strategies aim to capitalize on market momentum, irrespective of direction, have the potential to perform as well as equities over the long run, yet seek to get there with lower risk (volatility), smaller drawdowns, and do best when equity markets are at their worst (diversifier).

Core potential portfolio benefits

- Absolute Returns, Competitive with Equity Market Returns

- Low Correlation to Equities

- Positive Convexity in risk-off events - tend to perform better because they can amplify gains as market trends become more pronounced. Thus, during these periods, trend-followers can capture larger profits as they are positioned to benefit from the increased market volatility and sustained negative trends in other asset classes.

How they do it: Trend following strategies, target consistent diversified returns through systematic, rules-based investments in a portfolio of futures contracts across the equity, fixed income, commodity, and foreign exchange markets.

Needless to say, trend following strategies are a bit more complex, harder to understand, and not for everyone. They march to a different drummer. That’s the whole point. If you want to learn more about how they might help your portfolio – grab your drumsticks and let’s talk about it at your upcoming quarterly meeting.

Equity

U.S. stocks declined by several percent in the quarter. By broad segment, returns between ‘growth’ and ‘value’ were mixed, with the winner dependent on the index used, as higher-growth stocks decelerated from their high-flying path in the first half of the year. From a sector standpoint, energy saw double-digit gains in the quarter, following higher oil prices, while utilities, consumer staples, and technology lagged with the most negative returns.

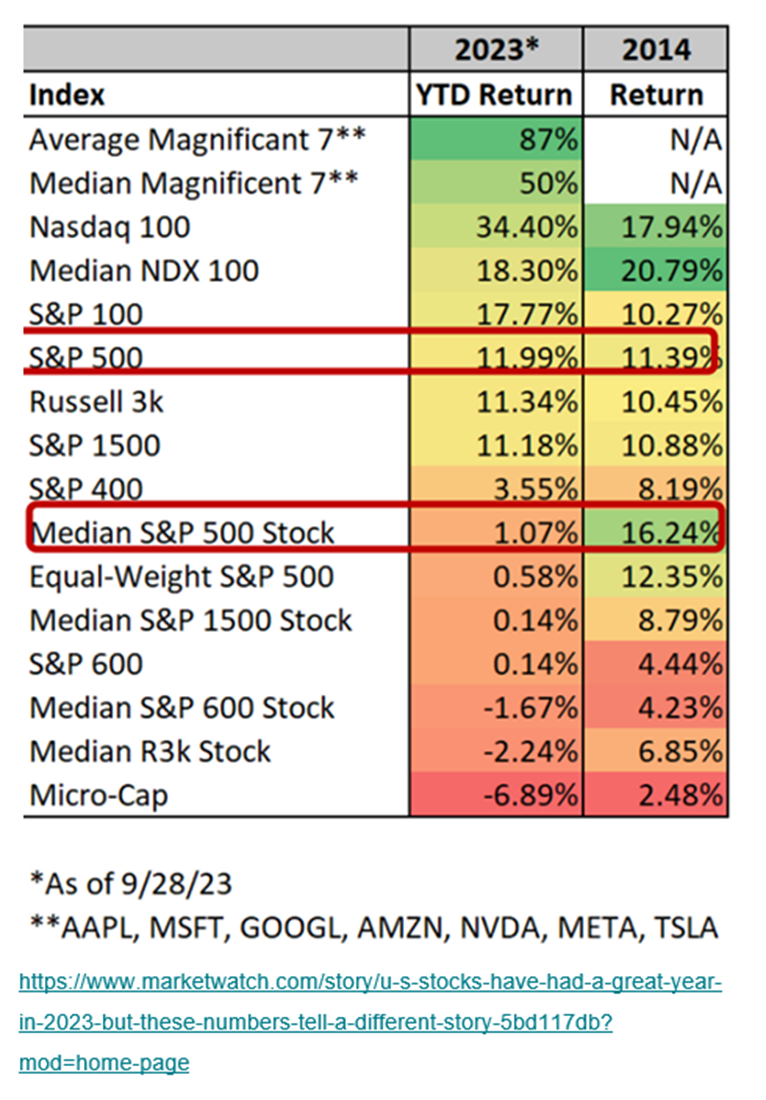

As promised in the opening of this letter, we wanted to address the “misleading returns” of the equity markets. We think the following Table 1 – Unbelievable Lopsidedness highlights this well:

Table 1 - Unbelievable Lopsidedness

We were taught that it was good writing etiquette to never let readers interpret a table or graph for themselves. It was best to show, tell, or demonstrate what they are looking at. This table is powerful on its own if you take a moment to really study it. SEVEN stocks dominated the returns of the market in 2023. By an unbelievable amount. The larger the technology stock, the better the return. On average, nearly every other stock was flat to negative. This is a very lopsided market. Does this mean anything? Perhaps not. But we think the lopsided advance in the S&P 500 masked what really occurred in the markets, a second year of bond and stock declines.

In line with these declines, negative headlines ruled the day: Strikes, Labor Unions Gaining Strength; Consumer has spent down their savings, Student loan repayments are starting, auto loan and credit card debt delinquencies moving higher, and government shutdowns (neutral on stock market reaction but it hits sentiment), US Govt debt rating downgrade, energy prices rise again, higher interest rates…to name some of the concerns our investors want to discuss.

It is no wonder September lived up to its reputation as being terrible and this start to October has certainly seen a pickup in volatility. Perhaps it is the Phillies’ strong start to the playoffs freaking out the market. Philadelphia has, on multiple occasions, won baseball's World Series in the same year the stock market crashed, or the U.S. economy entered a recession. When they lost the World Series in 2022, the world breathed a collective sigh of relief. Stock markets especially. The move up in markets was huge after their loss, but alas, they are back in the hunt and look at these markets. For those local Fightin Phils Phans, rest assured, you are hedged. World Series Win, awesome, bad portfolio. Loss, cry, enjoy market gains. You win one way or the other. For the non-Phils Phans, we know who you are rooting for.

Where appropriate, we have used some of this volatility to top off those investors that were perhaps a bit underweight equity relative to their long-term targets. However, despite the slight recent downward pressure on equities, we have not even hit a full 10% pullback on the market averages, which historically tends to be where we see some higher levels of rebalancing activity (though where appropriate, we have and expect to continue to push into more equities outside the magnificent 7.)

Significantly underweight international – why is that?

Surprisingly, foreign stocks have shown better performance relative to U.S. stocks over the past year, with developed market returns stealthily exceeding those of U.S. equities. (This is over the last 12 months, not the year-to-date period, YTD US stocks have once again outperformed.) Recent international outperformance originated from earnings growth coming in a bit better than their original downcast expectations as well as the effects of lower starting valuations. European conditions have continued to glide along a fine line between recession and no recession, with a smaller technology sector and higher energy costs. Most importantly, foreign stocks remain significantly undervalued compared to U.S. stocks, trading at levels not seen for a few decades. Such conditions of undervaluation have tended to coincide with attractive investment opportunities for the years looking ahead. Emerging markets also remain attractive generally based on valuation, although the story is more nuanced, with some nations (such as India) priced more expensively than others (like China). The China region, in particular, has underperformed expectations as their reopening from the pandemic lockdowns has so far proven disappointing, in addition to the hurdles of high debt loads and a troubled property sector. Of course, such extreme pessimism has tended to result in often unrealistically low valuations and the potential for positive opportunities looking ahead as well.

According to almost any measure, most Members’ Wealth investors are significantly underweight international stocks. While there is much debate on how to weight international stocks in a portfolio, most arguments suggest that 35-50% of an investor's stock portfolio should be international stocks. Members’ Wealth investors, overall, range between 0%-20%, with the rare investor approaching global targets of 35% to 50%. Even with small allocations, we would contend most investors would still say they have too much. International stock returns have been abysmal for over a decade. Top-performing emerging market strategies have returns in the low to mid-single digits and trail the S&P 500 by nearly, and in some cases more than, 10% annualized. Risk-adjusted, the returns are just awful, as emerging markets are generally considered riskier than US Markets. Developed international is not much better. Why bother? Why did investors invest in international in the first place? Diversification. Perhaps, but we thought diversification was supposed to help a portfolio. We want to be very vocal about this underweight. We have structured Members’ Wealth to not run top-down academically derived model-driven global portfolios. We have bottom-up investor-influenced custom portfolios with Members’ Wealth-educated and guided overlay. There is a huge difference and one where we believe our investors are best served. That being said, large differences can cause angst when they are not working in the investor's favor. The valuations of international equities are cheaper and US Dollar dominance relative to the Yen, the Euro, and the Yuan continues. A reversal of the latter, combined with a rerating of relative valuations between US and International stocks could support a period of sustained international equity outperformance. For those investors that want to consider a greater international allocation – let us start the conversation. Investors will also notice some trading in the international portions of their portfolio as we have identified what we believe are some superior investment opportunities overseas relative to what may already be in place in the portfolio. Let us know if you have questions.

Outlook

As the saying goes, markets tend to climb a “wall of worry”. This tendency seems to be a function of the forward-looking nature of markets. Once all the bad news is on the table it is time to start looking for better times ahead. While we’re not perhaps at that juncture just yet, sooner or later we will be. Markets are already starting to look ahead to the first or second quarter of 2024 with the guarded optimism a new year brings.

We do know that one very effective portfolio strategy during recessionary times is the diversification benefit of multi-asset portfolios, those with stocks, bonds and alternative asset classes included. Given current yields, bonds could provide a significant cushion if the economy does soften, and the Fed starts to think less about controlling inflation and more about helping the economy through a soft patch. If inflation does continue above the Fed’s target, owning stocks will help to keep abreast of higher prices as companies raise prices in line with their own inputs for materials, worker salaries and profit targets.

We try to make changes to your portfolio based on relative valuations in the various asset classes. For stocks, the higher valuations in some of the larger technology and information companies have made the inclusion of an emphasis on value stocks, with their lower relative prices, desirable. That has helped cushion portfolios over the last few months as the highflyers had their wings trimmed a bit.

Market declines are never any fun, and this one is no exception. Even while we know that episodes of falling prices for stocks and bonds are part and parcel of investing, it can be disconcerting to watch our portfolio value shrink over any period. While we don’t know how this next quarter or year will unfold, we do know that staying diversified and staying invested is the key to success over time.

Year-end planning considerations – to optimize financial health

While the list of planning considerations for any given year is long, hopefully we have covered most of these for your family already. What has not been covered will be discussed in each of your individual meetings this quarter. Here we wanted to highlight some things to think about as we approach the year's end. You can expect us at Members’ Wealth to be combing your portfolios for opportunities to harvest tax losses, (See our insight: aka Tax Efficiency Reaping). For those with required minimum distributions, the team has been busy checking and rechecking that the minimum has been or is set to be distributed. Speak up if you think this applies and has not been completed. The following is a list of 10 additional items for you to consider. If you feel they have not been adequately addressed in 2023, please let us know

- Review Your Financial Goals: Revisit your short-term and long-term financial goals. Assess how close you are to achieving them and adjust your strategies if necessary.

- Max Out Retirement Contributions: If you haven't reached the contribution limits for retirement accounts like 401(k)s or IRAs, consider making additional contributions to take full advantage of tax benefits.

- Assess Tax Liabilities: Estimate your tax liability for the year. Consider strategies like tax-loss harvesting to offset capital gains or maximizing deductions.

- Rebalance Your Portfolio: Markets can shift over time, potentially skewing your asset allocation. Periodically rebalancing helps ensure that your portfolio aligns with your risk tolerance and investment goals.

- Review Insurance Policies: Ensure your life, health, and property insurances are adequate. Consider updating beneficiaries and making any necessary coverage adjustments.

- Evaluate Your Debt: Review outstanding loans and credit card balances. Consider paying off high-interest debt or refinancing loans for better rates.

- Establish or Review an Emergency Fund: Ensure you have 3-6 months of living expenses in an easily accessible account, adjusting based on your personal comfort and risk tolerance.

- Review Your Estate Plan: Ensure your will, living will, and power of attorney documents are up to date. Consider setting up or revisiting trusts, especially if there have been significant changes in your life.

- Check Beneficiary Designations: Make sure beneficiary designations on retirement accounts and insurance policies reflect your current wishes, especially after life events like marriages, divorces, or the birth of children.

- Plan Charitable Giving: If you plan to make charitable donations, consider doing so before the year's end to maximize potential tax benefits.

We remind everyone, it's always a good idea to work on these topics in conjunction with Member’s Wealth and your tax and legal professionals, throughout the year, but the 4th quarter is also good to ensure you're making the most informed decisions tailored to your unique situation before we roll past yet another year on the calendar.

Conclusion

The third quarter did not disappoint in terms of our expectations for volatility (See Q2 2023 Newsletter). But volatility is the friend of the long-term investor. Long term, we are positive about the potential reward of both bond and equity investing to help you accomplish your goals. Combined with custom-tailored planning, tax efficiency, and asset preservation, we continue to work hard on your behalf to help you achieve your goals.

Thank you for your support and we look forward to seeing you at your next review meeting.

Your Members’ Wealth Team

Dane Czaplicki, CFA | Colleen Mahoney | Brian Carr, CFA

Tim Thomas | Marie Feindt, J.D. | Tim Macarak, CFP

[ii]https://www.reddit.com/r/unusual_whales/comments/170iqwe/the_stock_market_fear_and_greed_index_is_in/

[iii] Quote is attributed to Shelby Columb Davis and a book about Davis happened to be one of the first investment books I, Dane Czaplicki read. It was presented to me when I visited the office of Davis Investments, when I worked as an analyst at Lockwood Financial, a firm where a number of the founders of Members’ Wealth met many years ago.

[iv] A bond vigilante is a bond trader who threatens to sell, or actually sells, a large amount of bonds to protest or signal distaste with policies of the issuer. Selling bonds depresses their prices, pushing interest rates up and making it more costly for the issuer to borrow.

The term was coined by investor Ed Yardeni in the 1980s when bond traders sold Treasurys in response to the growing power of the Federal Reserve and its policies on the U.S. economy

[v] Duration is a measure of a bond's sensitivity to interest rate changes, representing the weighted average time until a bond's cash flows are received. The longer the duration, the more sensitive the bond price is to interest rate fluctuations. When rates are low, investors tend to shorten the duration of their bonds portfolios and when rates are higher, they tend to extend the duration.

You can learn more about how we serve our clients by tapping the button below.

Alternative investments, including hedge funds, involve risks that may not be suitable for all investors. These risks include (but are not limited to), the possibility that the investment may not be liquid, speculative investment practices may increase the risk of investment loss and higher fees may offset any potential gains. Investors should consider the tax consequences, costs and fees associated with these products before investing.

CS Planning Corp., doing business as, Members’ Wealth LLC provides investment advisory, wealth management, and other services to individuals, families, and institutional clients. Advisory services are offered through CS Planning Corp., an SEC registered investment advisor. Members’ Wealth does not provide legal, accounting or tax advice. Please consult your tax or legal advisors before taking any action that may have tax consequences.

Copyright © 2023 Members' Wealth LLC

Share this

- April 2025 (7)

- March 2025 (10)

- February 2025 (7)

- January 2025 (9)

- December 2024 (3)

- November 2024 (5)

- October 2024 (6)

- September 2024 (5)

- August 2024 (4)

- July 2024 (5)

- June 2024 (4)

- May 2024 (4)

- April 2024 (5)

- March 2024 (5)

- February 2024 (4)

- January 2024 (5)

- December 2023 (3)

- November 2023 (5)

- October 2023 (5)

- September 2023 (4)

- August 2023 (4)

- July 2023 (4)

- June 2023 (4)

- May 2023 (6)

- April 2023 (4)

- March 2023 (5)

- February 2023 (5)

- January 2023 (4)