Share this

Hurricanes and Portfolio Management

by Dane Czaplicki on Aug 15, 2023

"Strategies for Future Stormy Markets: Navigating the Sell Side and Embracing Portfolio Protection in Times of Calm"

Last week I spoke about opportunistic rebalancing to take advantage of short-term market volatility. However, it focused more heavily on the buyside of investing. What about the sell side? Anyone can buy an investment, but it takes quite a bit of skill to sell, to sell correctly that is. Have you ever had a winner roundtrip to a loser? No fun. Have you ever sold too soon and missed out on an opportunity? No fun either. Have you let the tax tail wag the dog and as a result you avoided taxes on the sale of the position at a gain, only to see the gains drift away. Great job – you avoided the tax alright but lost the gain. No Fun, No Fun, No Fun!

As managers of risk, we at Members’ Wealth believe we help our investors get to fully invested when they otherwise would not be, to stick with their strategies when faced with short term uncertainty, and as noted last week, to perhaps even take advantage of that uncertainty to buy opportunistically. But perhaps where we help investors the most is making sure they “do not rest on their laurels[i].”

For some reason, I cannot stop thinking about the relative calm in the investment markets in 2023. Volatility excites my investment taste buds, calm, however, brings out my investment anxiety.

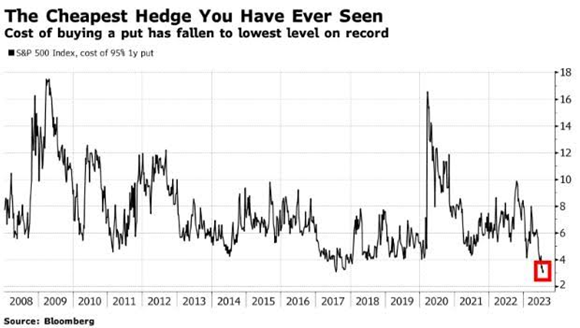

To us at Members’ Wealth, hurricane season extends beyond weather patterns. It aptly describes the unpredictable nature of the financial markets, where periods of tranquility can swiftly give way to storms of volatility and uncertainty. While some homeowners fortify their properties and stock up on essentials right before the hurricane hits, it is those that think and prepare for hurricanes long before the threat of storm that are positioned for the best potential outcomes. We think investors should adopt a similar mindset by considering any one of a number of portfolio actions while the markets are at a relative calm. The current environment of low volatility, record-low costs for buying put option protection, high quality fixed income yields, etc. present a unique opportunity for investors to prepare for potential market turbulence. Of course, the calm could last forever…

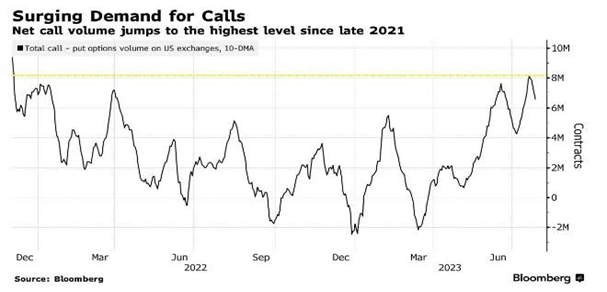

All the calm has sent the demand for Call Options soaring (See Graph – Surging Demand For Calls) and has pushed the cost of buying put options for protection to super low levels. (See Graph : The Cheapest Hedge You Have Ever Seen). Both graphs thanks to The Irrelevant Investor Blog[ii].

Historically, the financial markets have exhibited cycles of stability followed by periods of extreme volatility. Just as a calm sea can quickly turn into a tempestuous one, market conditions can shift unexpectedly, catching unprepared investors off guard. Buying portfolio protection, such as put options, during periods of tranquility allows investors to build a financial buffer that can withstand the impact of sudden market downturns. The cost-effectiveness of purchasing puts in low volatility periods should not be underestimated. When options premiums are relatively low, investors can acquire downside protection at a reduced expense, effectively insuring their portfolios against potential losses.

The adage "better safe than sorry" rings true in the world of investing. While it's tempting to bask in the glow of a serene market, seasoned investors recognize the need to balance risk and reward. Just as homeowners install storm shutters to safeguard against potential damage, investors can utilize portfolio protection to shield their hard-earned gains from market turbulence. By taking preemptive action during calm periods, investors can mitigate the impact of unforeseen events, ultimately preserving their investment capital.

At Members’ Wealth, we think perhaps the most important part of the “don’t rest on your laurels” exercise, the psychological benefits of reviewing your portfolio, whether action is taken or not, should not be taken for granted, nor overlooked. The fear and anxiety that accompany market downturns can lead to irrational decision-making, prompting investors to make hasty choices that can negatively impact their long-term financial goals. When a portfolio is fortified with protection, actually or psychologically, investors are better equipped to maintain a disciplined approach, avoiding knee-jerk reactions that can lead to regrettable losses. This psychological buffer allows investors to weather storms with greater poise and rationality.

While buying portfolio protection, rebalancing, or otherwise shoring up the portfolio in times of market tranquility may seem like an unnecessary expense to some, it is important to recognize that the costs associated with protection are a small price to pay compared to the potential losses incurred during a market downturn. By viewing these actions as an insurance policy for your investments, you position yourself to mitigate risk and enhance the overall resilience of your financial portfolio.

Consider the scenario of a ship captain. Before embarking on a journey, the captain ensures that lifeboats and safety equipment are in place, even when the waters are calm. This preparedness does not indicate an expectation of disaster; rather, it reflects a prudent approach that acknowledges the unpredictable nature of the sea. Similarly, investors should embrace a proactive stance, buying portfolio protection, or preparing through alternative means, is not a signal of impending catastrophe, but as a strategic move to navigate the inevitable ebb and flow of the markets.

In conclusion, just as hurricane season reminds us to prepare before the storm, so does the relative calm of markets raises my investment anxiety and means it is a good time for investors to check their preparedness. Low volatility environments and record-low costs for acquiring put option protection provide an opportune moment for investors to insulate their portfolios against potential market upheavals. By embracing portfolio protection, investors can fortify their financial positions, reduce the psychological toll of market turbulence, and maintain a steady course toward their long-term goals. Remember, in investing, as in life, preparedness is key, and the decisions you make during tranquil times can make all the difference when the storm clouds gather. This is not to say we want investors to have to use their life vests and lifeboats.

[i] [i] Rest on one’s laurels comes from the ancient Greek and Roman societies, where high-ranking and high-achieving people were awarded crowns made of laurel leaves to mark their accomplishments. To “rest on our laurels” means to relax and rely on our past achievements or success as justification for not achieving new things or new success.

[ii] https://theirrelevantinvestor.com/2023/08/02/animal-spirits-everything-is-up-this-year/

About the Author – Dane Czaplicki, CFA®

Dane Czaplicki is CEO of Members’ Wealth, a boutique wealth management firm that offers a comprehensive approach to serving individuals, families, business owners, and institutions. The firm’s goal is to preserve and grow its clients’ wealth to endure over time, while thoughtfully evolving its strategy to suit an ever-changing world. With over 20 years of wealth management experience, Dane and the Members' Wealth team thrive on bringing clarity and confidence to clients' unique situations. He believes everyone needs sound financial advice from someone whose interests are aligned with theirs, and is determined to put service before all else.

Dane received his MBA from The Wharton School of Business at the University of Pennsylvania and his bachelor’s degree from Bloomsburg University. Outside work, he enjoys spending time with his wife and kids, hiking and camping, reading, running, and playing with his dog. To learn more about Dane, connect with him on LinkedIn.

To get in touch with the Members’ Wealth team today, I invite you to email info@memberswealthllc.com or call (267) 367-5453.

You can learn more about how we serve our clients by tapping the button below.

Alternative investments, including hedge funds, involve risks that may not be suitable for all investors. These risks include (but are not limited to), the possibility that the investment may not be liquid, speculative investment practices may increase the risk of investment loss and higher fees may offset any potential gains. Investors should consider the tax consequences, costs, and fees associated with these products before investing.

CS Planning Corp., doing business as, Members’ Wealth LLC provides investment advisory, wealth management, and other services to individuals, families, and institutional clients. Advisory services are offered through CS Planning Corp., an SEC-registered investment advisor. Members’ Wealth does not provide legal, accounting or tax advice. Please consult your tax or legal advisors before taking any action that may have tax consequences.

Copyright © 2023 Members' Wealth LLC

Advisory services are offered through CS Planning Corp., an SEC-registered investment advisor.

Share this

- April 2025 (7)

- March 2025 (10)

- February 2025 (7)

- January 2025 (9)

- December 2024 (3)

- November 2024 (5)

- October 2024 (6)

- September 2024 (5)

- August 2024 (4)

- July 2024 (5)

- June 2024 (4)

- May 2024 (4)

- April 2024 (5)

- March 2024 (5)

- February 2024 (4)

- January 2024 (5)

- December 2023 (3)

- November 2023 (5)

- October 2023 (5)

- September 2023 (4)

- August 2023 (4)

- July 2023 (4)

- June 2023 (4)

- May 2023 (6)

- April 2023 (4)

- March 2023 (5)

- February 2023 (5)

- January 2023 (4)