Share this

Bond Bear Market: Navigating the Shift from Historic Lows to Rising Yields

by Dane Czaplicki on Oct 09, 2023

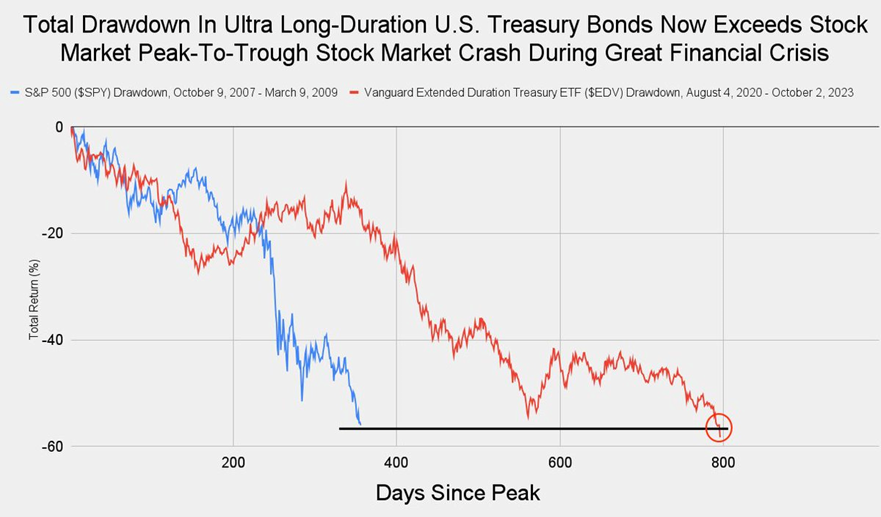

Safe investments – US Treasuries are in as bad if not worse bear market than US Stocks were during the 2008 financial crisis. See graph below[i]:

We have never met a person who looked back at the depths of 2008 and said, I wish I bought less stocks when they were down at those lows. Everyone wishes they had bought more, backed up the truck so to speak. Now we never know it at the time, but the most money is made in the throes of bear markets. While we are not signaling all clear to run head long into long term US Treasuries or any particular long dated bond for that matter, we are feeling strongly that now is a better time to invest in bonds than 08/04/2020 when the 10-year Treasury yield hit an all-time low of 0.52% (and that was the nominal rate before adjusting for inflation)

August 2020 10-year treasury yield of 0.52% = bad.

Now 10-year treasury yield 4.8% = good.

Notice, we are not saying great and not saying no risk but let’s call a spade a spade. If you are not starting to get more interested, then when do you? We can never time it perfectly, and rates can of course go higher, much higher, but investors should at least fuel up the truck, adjust the rearview mirror, turn on the backup truck alarms and lights, and start to buy some very nice real yields. What are real yields?

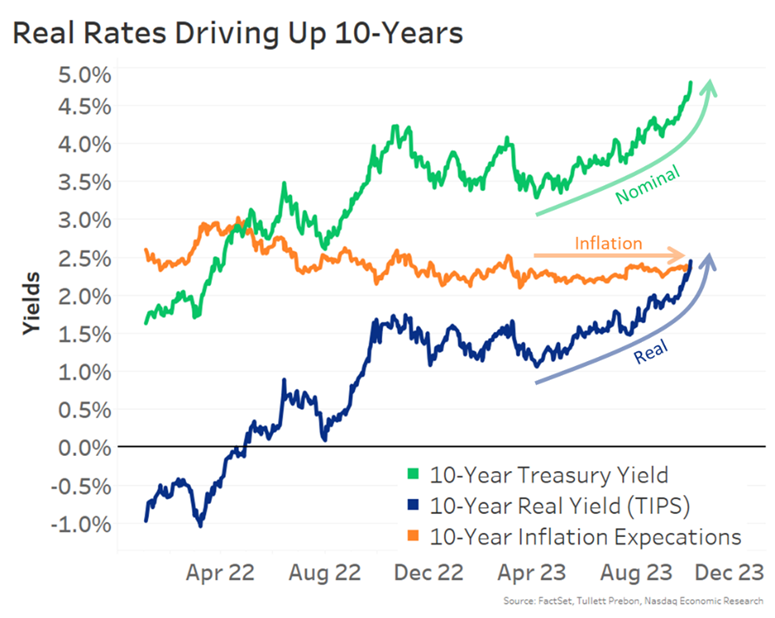

Real interest rates represent the rate of interest an investor expects to receive after allowing for inflation. It's calculated by subtracting the expected inflation rate from the nominal interest rate.

Recently, According to Nasdaq Dorsey , “In fact, real 10-year rates are already well above expected long-term inflation. Since April, inflation expectations have been mostly unchanged, at around 2.5%. That means “real” (after inflation returns) rates have gone from negative (-1.0%) in 2022, to almost +2.5%. See Graph Below

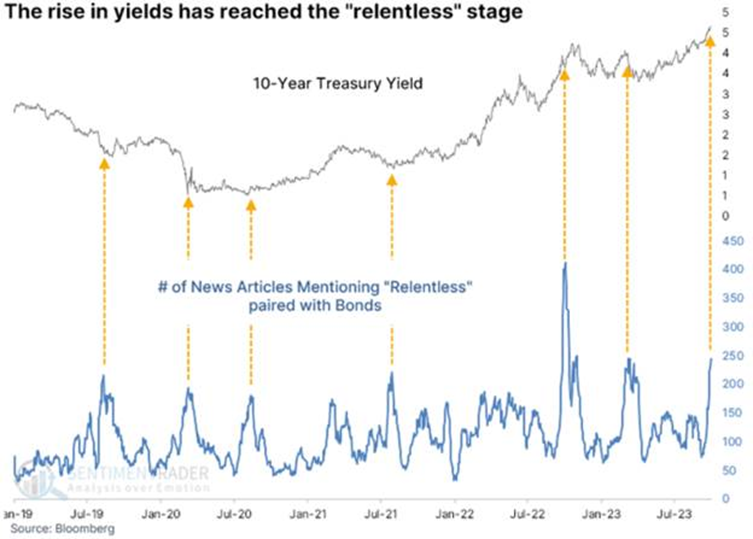

All this talk about the relentless move up in yield reminds us of the relentless move down in stock prices in 2008. Here is a graph measuring the news articles mentioning “relentless”.

There is also currently a lot of talk about the 5% mark on 10 year and 30-year treasuries. We cannot seem to find anything special or in particular about the 5% mark. But consensus is that yields soaring above 5% would be bad, hanging out there would be ok, going lower, perhaps even better. Inflation could send it higher; recession could send it lower. From an investing standpoint 5% is better than 0.52%. We remind investors that this same talk was around as rates increased past 3% and 4%. The saying went, equity markets cannot withstand a higher yield environment. Leave it up to stocks to make a mockery of the predictions, time and again. There is no doubt a level where rates could be too high. Don’t let anyone tell you what it is.

Rates have been abnormally low for 15-plus years. Abnormally low. We have managed the bond portion of portfolios with shorter duration[ii] for just as long for clients, both at Members’ Wealth and predecessor firms. Rates are normalizing, getting there is painful. But being there is welcomed, and we will continue to adjust portfolios accordingly for the new environment. We are in a bond bear market, perhaps of epic proportion, and we plan on laying the foundation for making the most money in a bear market, even if we don’t quite yet know it at this time.

[i] Callum Thomas @Callum Thomas (Weekly S&P500 #ChartStorm)

[ii] Duration is a measure of a bond's sensitivity to interest rate changes, representing the weighted average time until a bond's cash flows are received. The longer the duration, the more sensitive the bond price is to interest rate fluctuations. When rates are low, investors tend to shorten the duration of their bonds portfolios and when rates are higher, they tend to extend the duration.

Exchange-traded funds (ETFs) are sold by prospectus. Please consider the investment objectives, risk, charges and expenses carefully before investing. The prospectus provides a balanced analysis of the investment risks and benefits. Read it carefully before you invest. ETF shareholders should be aware that the general level of stock or bond prices may decline, thus affecting the value of an exchange-traded fund. Although exchange-traded funds are designed to provide investment results that generally correspond to the price and yield performance of their respective underlying indexes, the funds may not be able to exactly replicate the performance of the indexes because of fund expenses and other factors.

About the Author – Dane Czaplicki, CFA®

Dane Czaplicki is CEO of Members’ Wealth, a boutique wealth management firm that offers a comprehensive approach to serving individuals, families, business owners, and institutions. The firm’s goal is to preserve and grow its clients’ wealth to endure over time, while thoughtfully evolving its strategy to suit an ever-changing world. With over 20 years of wealth management experience, Dane and the Members' Wealth team thrive on bringing clarity and confidence to clients' unique situations. He believes everyone needs sound financial advice from someone whose interests are aligned with theirs, and is determined to put service before all else.

Dane received his MBA from The Wharton School of Business at the University of Pennsylvania and his bachelor’s degree from Bloomsburg University. Outside work, he enjoys spending time with his wife and kids, hiking and camping, reading, running, and playing with his dog. To learn more about Dane, connect with him on LinkedIn.

To get in touch with the Members’ Wealth team today, I invite you to email info@memberswealthllc.com or call (267) 367-5453.

You can learn more about how we serve our clients by tapping the button below.

Alternative investments, including hedge funds, involve risks that may not be suitable for all investors. These risks include (but are not limited to), the possibility that the investment may not be liquid, speculative investment practices may increase the risk of investment loss and higher fees may offset any potential gains. Investors should consider the tax consequences, costs, and fees associated with these products before investing.

CS Planning Corp., doing business as, Members’ Wealth LLC provides investment advisory, wealth management, and other services to individuals, families, and institutional clients. Advisory services are offered through CS Planning Corp., an SEC-registered investment advisor. Members’ Wealth does not provide legal, accounting or tax advice. Please consult your tax or legal advisors before taking any action that may have tax consequences.

Copyright © 2023 Members' Wealth LLC

Advisory services are offered through CS Planning Corp., an SEC-registered investment advisor.

Share this

- April 2025 (7)

- March 2025 (10)

- February 2025 (7)

- January 2025 (9)

- December 2024 (3)

- November 2024 (5)

- October 2024 (6)

- September 2024 (5)

- August 2024 (4)

- July 2024 (5)

- June 2024 (4)

- May 2024 (4)

- April 2024 (5)

- March 2024 (5)

- February 2024 (4)

- January 2024 (5)

- December 2023 (3)

- November 2023 (5)

- October 2023 (5)

- September 2023 (4)

- August 2023 (4)

- July 2023 (4)

- June 2023 (4)

- May 2023 (6)

- April 2023 (4)

- March 2023 (5)

- February 2023 (5)

- January 2023 (4)