Share this

After the Fed

by Dane Czaplicki on Sep 25, 2023

Post-Fed: A Landscape of Opportunity

The Federal Reserve Open Market Committee, as anticipated, maintained the Fed funds rate at 5.25-5.50% on 09/20/2023. The vote was unanimous, and the formal statement received only minor modifications, signifying an upgrade in economic activity from ‘moderate’ to ‘solid.’ However, job gains were recategorized from ‘robust’ to ‘slowed... but remain strong.’ Interestingly, references to the U.S. banking system lingered in the statement, hinting at potential concerns about tighter credit conditions affecting future activity.

The Quarterly Fed’s Summary of Economic Projections (SEP) anticipates a consistent path for the Fed funds in 2023, at 5.6%—implying another hike. However, projections for 2024 and 2025 have been raised to 5.1% and 3.9%, respectively, while the longer-run level remains stable at 2.5%.

Markets were not surprised by this week’s inactivity, with the probability of maintaining the current rate having escalated from 80% to 99% in the past month. Futures suggest a 40% likelihood for one more rate hike in 2023, perceived as the cycle’s zenith.

Speculating the Future & Learning from the Past

The predominant question arises: Will the interest rates persist at higher levels, or will a rate reduction cycle ensue?

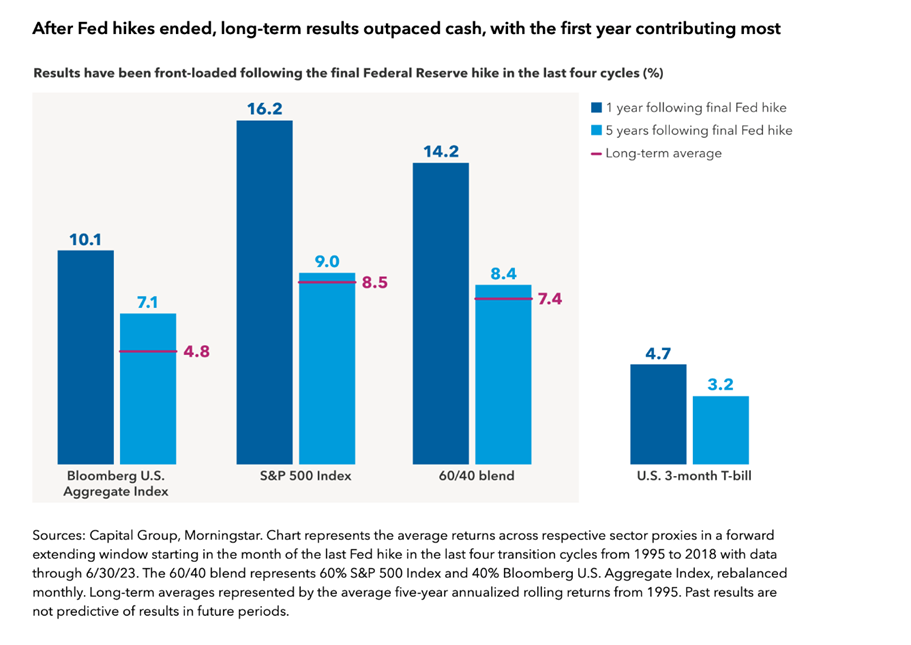

If you align with our belief at Members’ Wealth, considering the Fed might have concluded—or is near concluding—the rate increases, then the unfolding scenario surely intrigues you. Delving into history provides some perspective. Analyzing the culmination of the last four rate-increasing cycles reveals that while cash investments lost momentum, stocks and bonds thrived.

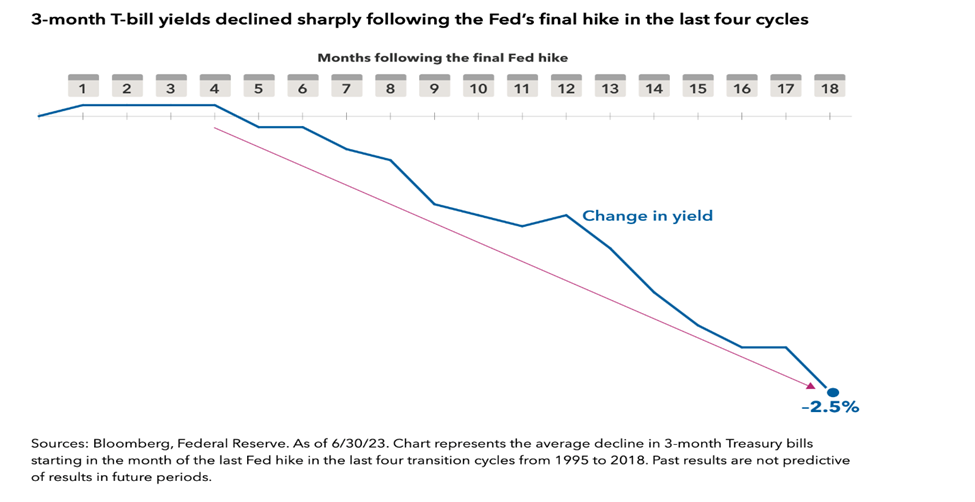

At approximately 5% yields, remaining in cash, short-term treasury, and money markets seems tempting, especially with the Fed nearing its limit. However, one analysis by the Capital Group elucidates that post-Fed hikes, yields on cash-like investments have typically deteriorated swiftly. See Graph 1: 3 Month T-Bill Yields Decline:

If this historical trend repeats, pivoting towards active investment in stocks and bonds appears more prudent. In both future 1 and 5 periods following the conclusion of a rate hike, stocks and bond returns are positive, but investors should not wait and see as the stronger positive returns appear to be front end loaded. (See Graph 2) – After Fed Hikes Ended.

**Investors cannot invest directly in an index

Investment Strategies: Past & Present

Reviewing historical patterns serves as a reference but scrutinizing current conditions is paramount. For a thorough quarterly review and insight into the year-end outlook, our forthcoming Q3 letter will provide detailed analyses. Meanwhile, we at Members’ Wealth continue to adapt, extending the duration and acquiring longer-term bonds to ensure that our portfolios are strategically positioned to capture emerging opportunities.

Executing such strategies requires unwavering discipline as the allure of a 5% cash yield can lead to substantial inertia. The emotional side of investing, characterized by the lingering sting of past losses, is very real. Despite the current appeal of rates on Certificates of Deposit and money markets, a seasoned investor acknowledges the impermanence of market conditions.

Navigating the Market Landscape

There exists a potential risk of remaining excessively liquid, thereby missing out on lucrative opportunities due to delayed market re-entry. It’s crucial to be proactive rather than idle, waiting for the optimal moment. Bonds are not the only game in town. Historical patterns also suggest promising returns in stocks post a rate hike, but of course, stock markets tend to be more fickle and average long term returns mask short-term volatility. With any luck this fall will present some of that short-term volatility for long-term solid entry points. We remain poised.

We anticipate a detailed exploration of our market strategies and perspectives in our upcoming Q3 letter. Remember, the market doesn’t wait for you; get out there and get after it.

**Standard & Poor's 500 or simply the S&P 500, is a stock market index tracking the performance of 500 large companies listed on stock exchanges in the United States. It represents the stock market's performance by reporting the risks and returns of the biggest companies. Investors use it as the benchmark of the overall market, to which all other investments are compared.

Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and non-agency).

About the Author – Dane Czaplicki, CFA®

Dane Czaplicki is CEO of Members’ Wealth, a boutique wealth management firm that offers a comprehensive approach to serving individuals, families, business owners, and institutions. The firm’s goal is to preserve and grow its clients’ wealth to endure over time, while thoughtfully evolving its strategy to suit an ever-changing world. With over 20 years of wealth management experience, Dane and the Members' Wealth team thrive on bringing clarity and confidence to clients' unique situations. He believes everyone needs sound financial advice from someone whose interests are aligned with theirs, and is determined to put service before all else.

Dane received his MBA from The Wharton School of Business at the University of Pennsylvania and his bachelor’s degree from Bloomsburg University. Outside work, he enjoys spending time with his wife and kids, hiking and camping, reading, running, and playing with his dog. To learn more about Dane, connect with him on LinkedIn.

To get in touch with the Members’ Wealth team today, I invite you to email info@memberswealthllc.com or call (267) 367-5453.

You can learn more about how we serve our clients by tapping the button below.

Alternative investments, including hedge funds, involve risks that may not be suitable for all investors. These risks include (but are not limited to), the possibility that the investment may not be liquid, speculative investment practices may increase the risk of investment loss and higher fees may offset any potential gains. Investors should consider the tax consequences, costs, and fees associated with these products before investing.

CS Planning Corp., doing business as, Members’ Wealth LLC provides investment advisory, wealth management, and other services to individuals, families, and institutional clients. Advisory services are offered through CS Planning Corp., an SEC-registered investment advisor. Members’ Wealth does not provide legal, accounting or tax advice. Please consult your tax or legal advisors before taking any action that may have tax consequences.

Copyright © 2023 Members' Wealth LLC

Advisory services are offered through CS Planning Corp., an SEC-registered investment advisor.

Share this

- April 2025 (7)

- March 2025 (10)

- February 2025 (7)

- January 2025 (9)

- December 2024 (3)

- November 2024 (5)

- October 2024 (6)

- September 2024 (5)

- August 2024 (4)

- July 2024 (5)

- June 2024 (4)

- May 2024 (4)

- April 2024 (5)

- March 2024 (5)

- February 2024 (4)

- January 2024 (5)

- December 2023 (3)

- November 2023 (5)

- October 2023 (5)

- September 2023 (4)

- August 2023 (4)

- July 2023 (4)

- June 2023 (4)

- May 2023 (6)

- April 2023 (4)

- March 2023 (5)

- February 2023 (5)

- January 2023 (4)