Multi-Family Office Services

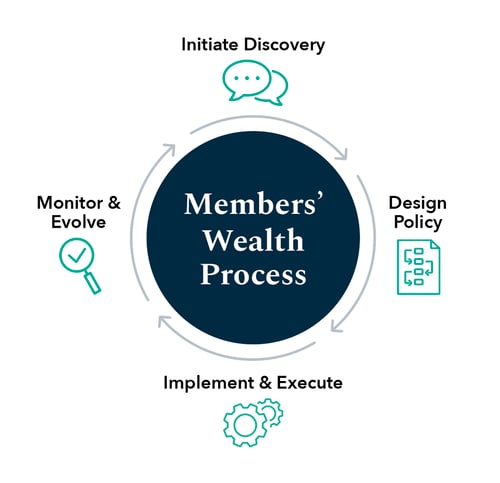

At Members' Wealth, we coordinate your investment, tax, legal, and estate demands through our unique approach. Our goal is to preserve and grow your wealth to endure over time, while thoughtfully evolving your strategy to suit an ever-changing world.

The Members' Wealth Approach

At Members’ Wealth we develop, implement, and execute custom planning and investment strategies, rooted in finance and law, enhanced with behavioral analysis and fine-tuned to each individual, family or business need.

Your Plan Must Evolve

Almost all life events bring new financial risks and opportunities, so you need a financial plan that evolves.

Planning is not a point in time but an iterative process. Our process begins by taking a holistic approach to personal finance.

Our advisors construct a blueprint for your financial plan that becomes the basis of the relationship with our firm.

Discovery begins with an interview between you and Members' Wealth so we can gather the information needed to establish an understanding regarding your:

- Investment Objectives

- Risk Tolerance

- Cash Flow Demands

- Tax Situation

- Family Estate Objectives

Planning is indispensable. The details of a projection which are designed years in advance are often incorrect, but the planning process demands the thorough exploration of options and contingencies. The knowledge gained during this probing is crucial to the selection of appropriate actions as future events unfold.

- Investment Policy Statement

- Tax Plan

- Cash Flow Plan

- Estate Plan

- Asset Protection Review and Plan

A plan is only as good as its execution. Once the plan is established and agreed upon, Members' wealth will execute, implement and administer your plan toward your goals.

- Set Time Lines

- Trade

- Analyze

- Aggregate

- Report

Regular review meetings will prepare you to evolve your plan to maximize efficacy and to keep up with your ever changing life.

- Performance Reporting Feedback

- Rebalancing

- Tax-Loss Harvesting

- Asset Location Review

- Estate Plan Review

Comprehensive Planning

The details of a plan which are designed years in advance are often incorrect, but the planning process demands the thorough exploration of options and contingencies.

Financial Planning

Business Planning

Estate Planning

Tax Planning

Comprehensive Management

We develop, implement, and execute custom strategies, rooted in finance and law, enhanced with behavioral analysis and fine-tuned to each individual Member's needs.

Investment Management

Risk Management

Asset Location

Asset Protection

Reinvent the way You Experience

Wealth Management